In our last post The Coming Inflection Point - Part 1 we reviewed how the computing industry dramatically changed after it reached its strategic inflection point.

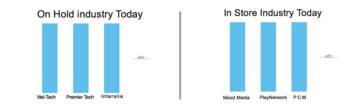

So let’s take a look at the On-Hold and In-Store music industry, and see if anything looks familiar:

Notice the parallels to the vertically aligned computing industry as illustrated in our part 1 post.

Just like the computing industry of the 80s, the In-Store music suppliers are essentially vertical silos, each with a different end-to-end proprietary offering. They have their own closed hardware running their own closed software, their own music libraries, own music programmers, and own integrated sales organization.

Consequently, in today’s vertically aligned environment, if one were to change In-Store music suppliers, say from Mood to Play, it would not be a trivial exercise. (One would probably have to rip out equipment and redo everything: very reminiscent of the situation in our part 1 post if one wanted to change computing supplier, from say Wang to Sperry/Univac).

Likewise for On-Hold: the typical On-Hold equipment suppliers all provide different end-to-end proprietary systems, running their own proprietary hardware with their own proprietary firmware, content management system and so forth.

Again if one were to attempt to change from, say Nel-Tech to Interalia (or to change from USB MOH to Networking MOH), it is also not such a trivial undertaking: One would have a similar problem.

The future of On-Hold and In-Store is depicted above, as best it is known at present. Just as happened in the computing industry, our industry is completely “reconstituting” itself into horizontal layers.

The signs of this massive change are already around us. For example, it can be seen in the emergence of music providers who specialize just in music, and allow it to be managed via a variety of content management systems, combined with other content sources (e.g. messaging) and delivered over a variety of delivery platforms.

This future is likely no more than a few years away, and as we show below, everything suggests this kind of change is inevitable.

Some of you may feel you’ve experimented with parts of such horizontal integration already, and may have found it painful. While the inflection is in progress, expect there to be some birthing pains.

Clearly we have borrowed liberally from Andy Grove’s insights in the foregoing. However, there are numerous other unconnected business researchers (e.g. Clayton M Christensen from HBS) with their own industry-independent models, who also suggest this kind of change is inevitable for our industry.

Why is such a massive change inevitable?

The CMC/HBS disruption model says: In the early days, while new technology is still bleeding edge, its easier to get it all to work under the tight end-to-end control afforded by vertical integration. A perfect example of this is RIM/Blackberry, who had to make chipsets, hardware, operating system, software etc for their initial Blackberry product (i.e. Vertical Integration) so that it would be good enough to be accepted by the marketplace.

Then, as the technology matures, supply and demand results in modularization, which manifests itself as horizontal supply or layering. Inside a horizontal supply model, within each modular level, the expertise level becomes very specific, akin to a little ‘Vertical’ inside the module.

An example of this is the Android ecosystem: today one can purchase Android phones made by LG, using chips made by Samsung, running an OS supplied by Google and based on Linux, with Apps written by a huge variety of App publishers.

Clearly, the smartphone market has also transitioned from a Vertical to a Horizontal model. And notice what has happened to RIM/Blackberry in the process.

Massive industry shakeouts occur during such a transition from a vertical to horizontally aligned industry. Examples abound: Wang, Sperry/Univac, RIM/Blackberry, Palm, and many more.

When dramatic change of this kind is taking place within an industry there are only two outcomes:

- Business growth - you adapt to the change, take advantage of the changing environment and grow the business.

- Business decline - you fail to adapt to the change and the business declines and drops out.

Since most providers and music suppliers are not directly shaping new technologies, they must rely on technology partners to help them to navigate the changes. The choice of technology partners becomes a critical choice - success or failure directly depends on ‘hitching your cart to the right horse’.

Key Takeaways:

Recognize this industry transition is coming. Carefully consider to which horse you hitch your cart. Be careful not to become overwhelmed by the change, or by the technological moving parts you need to keep track of: the right technology partner can help you navigate this important transition and come out on the winning end.

Stay tuned for our next post on the Inflection Point in about a week’s time.